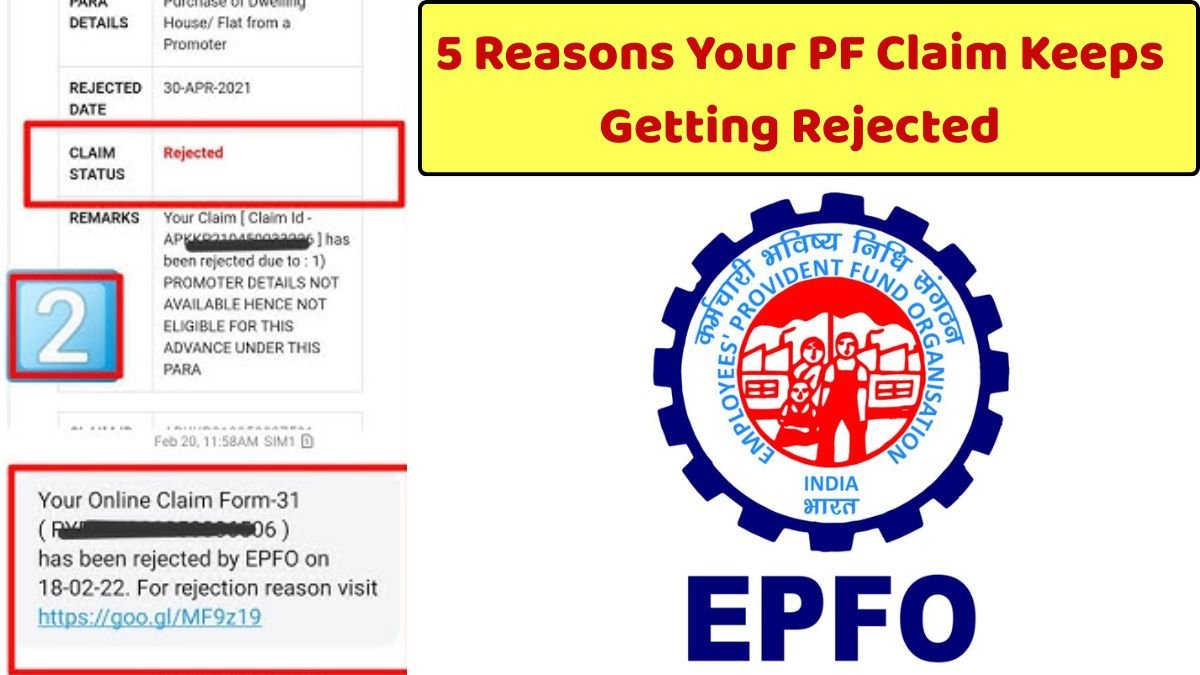

Imagine this you’ve been working hard for years, saving money every month into your PF account, dreaming that one day this fund will support your family, your retirement, or even an emergency. But when the time finally comes to withdraw it, your PF claim gets rejected.

Sounds frustrating, right? Sadly, you’re not alone. In the financial year 2023–24, nearly 1 out of every 4 PF claims was rejected by EPFO, leaving almost 1.6 crore employees struggling to access their own savings. These aren’t just numbers; these are stories of real people who needed their money but were left waiting because of small, avoidable mistakes.

The Most Common Reasons for PF Claim Rejections

Sometimes it’s not big issues but tiny errors that cause your PF claim to get rejected. Here are the most frequent ones:

Mismatch in Name or Date of Birth

Even a small spelling error in your name, or a wrong digit in your date of birth, can stop your claim. EPFO’s system is strict—if your details don’t exactly match with Aadhaar, PAN, or employer records, your claim won’t go through.

Tip: Always cross-check your records in the EPFO portal and get them corrected at the earliest.

UAN Not Linked to Aadhaar

Your UAN (Universal Account Number) must be linked to your Aadhaar. Without this, the system won’t allow the claim to proceed.

Sometimes, even if KYC shows “Approved” on the portal, it may display “Undefined” elsewhere, creating a technical mess. Thousands of employees face this glitch every year.

Tip: Log in to the EPFO member portal and confirm your Aadhaar is successfully linked. If not, update it immediately.

Two UANs Under One Person

Changed jobs multiple times? There’s a chance you may have ended up with two different UANs. But remember—EPFO rules allow only one UAN per person. If you don’t merge them, your PF claim will stay stuck.

Tip: If you have multiple UANs, request a merger through the EPFO portal or raise a grievance online.

Bank Account Errors

A wrong bank account number or incorrect IFSC code can stop your claim from being credited. Even small mistakes like spelling errors in the account holder’s name can cause trouble.

Tip: Verify your bank details in your EPFO profile before submitting a claim.

Wrong Family or Relationship Details

This is something many people don’t even realize. If your PF record shows the wrong family relation—like your mother’s name listed as your father’s, or your spouse’s name recorded incorrectly—your PF claim can get stuck for months.

Tip: Correct family details through your employer or directly via the EPFO portal.

How to Avoid PF Claim Rejection

- Want your PF money to reach you without delays? Here’s a quick checklist:

- Regularly update and verify your details on the EPFO Member Portal.

- Make sure your UAN is linked to Aadhaar and PAN.

- Confirm your bank details are 100% accurate.

- Double-check with your employer before raising a claim.

- If stuck, use the EPFO Grievance Portal to raise complaints.

FAQs on PF Claim Rejection

Q1. Why does EPFO reject PF claims so often?

Because even tiny errors in details like name, DOB, Aadhaar, or bank info create mismatches in the system.

Q2. How can I check if my UAN is linked to Aadhaar?

Log in to the EPFO Member e-Sewa portal and check your KYC status under the “Manage” section.

Q3. Can I have two UANs?

No. Each employee must have only one UAN. If you have more than one, you need to merge them via the EPFO portal.

Q4. What should I do if my PF claim gets rejected?

Check the rejection reason in your EPFO account, correct the errors, and then reapply. If problems persist, raise a grievance online.

Q5. Does employer approval matter for PF withdrawal?

Yes, especially if it’s a transfer claim. Always confirm your employer has updated your exit date and other details.