Have you ever stood in a supermarket aisle, calculating whether you can afford that extra packet of cheese or a new pack of butter? Or maybe you’ve been delaying buying a fridge, TV, or even a washing machine because the price tag feels just a little too heavy. You’re not alone millions of families in India live with that same pinch every single day.

But here’s some good news that feels like a true festival gift. On Independence Day 2025, Prime Minister Narendra Modi announced a major GST reform that could finally bring some relief to your wallet. This isn’t just another policy update—it’s a move that promises cheaper daily essentials, reduced tax burden, and more breathing room for the middle class and small businesses.

The government plans to cut down four GST slabs (5%, 12%, 18%, 28%) into just two, making things simpler and much more affordable. Some items could see a 7% tax cut, while others may get as much as 10% relief. Imagine the savings this could bring to your monthly budget

What Exactly Is Changing in GST 2025?

Right now, India has four main GST slabs: 5%, 12%, 18%, and 28%. But let’s be honest—most of us don’t think about slabs when buying groceries or home appliances. What matters is the final bill.

Here’s what’s happening:

- Items under 12% GST will likely move to the 5% slab → meaning a 7% reduction.

- Many products under the 28% slab will shift to 18% GST → giving you a 10% cut in taxes.

- The idea is simple—make everyday goods cheaper and reduce the tax load on families and businesses.

Think about it: food items, packaged goods, electronics, and even appliances will feel lighter on your pocket. And for businesses, especially small traders and shop owners, this change could boost sales since people will be more willing to spend.

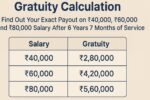

Why This Matters for the Middle Class

The middle class has always been caught in the middle—earning enough to not qualify for subsidies but not rich enough to ignore price hikes. Every extra tax feels like a burden.

With GST cuts:

Groceries like cheese, ghee, butter, dry fruits, jams, sauces, and even diabetic food will now fall into the 5% slab. That means your kitchen essentials could cost less every month.

Packaged drinking water, pasta, noodles, ready-to-eat snacks, and coconut water—all will get cheaper. Imagine your kids’ favorite snacks or your daily tiffin items costing less.

For bigger purchases like TVs, washing machines, refrigerators, and ACs, you could see 10% less tax. That’s a big saving if you’ve been holding back on upgrading your home appliances.

List of Items with 10% GST Reduction (From 28% → 18%)

Here’s where the real relief comes in—goods that used to feel like luxuries might now become more affordable.

Major Items with 10% GST Cut:

- Electronics & Appliances:

- Air-conditioners

- Dishwashing machines

- Electric batteries (except lithium-ion)

- Monitors and projectors

- Televisions (specific sizes)

- Vehicles & Auto Parts:

- Motorcycles, scooters, and bikes

- Cars and motor vehicles

- Auto parts and accessories

- Commercial vehicle engines and components

- Luxury & Lifestyle Goods:

- Cigar, cigarettes, and tobacco products

- Aerated and caffeinated drinks

- Carbonated fruit beverages

- Cement and construction materials

- Others:

- Lottery, betting, and gambling services

- Personal-use aircraft and yachts

This means if you’re planning a big purchase—whether it’s for your home, your business, or your personal lifestyle—you’ll end up paying a lot less in taxes.

List of Items with 7% GST Reduction (From 12% → 5%)

This is where households will feel the maximum impact because these are everyday grocery and kitchen items.

Daily Essentials Becoming Cheaper:

- Dairy Products: Condensed milk, butter, ghee, cheese, dairy spreads

- Dry Fruits & Nuts: Almonds, pistachios, cashews, walnuts, figs, dates, raisins

- Packaged Food & Drinks:

- Jams, sauces, ketchup, mayonnaise

- Pasta, noodles, macaroni, couscous

- Packaged coconut water

- Diabetic-friendly foods

- Soy milk and fruit-based beverages

- Processed & Preserved Foods:

- Pickles, jams, jellies, chutneys

- Frozen vegetables and fruits

- Ready-to-eat snacks, namkeens, mixtures

- Other Daily Use Goods:

- Packaged drinking water (20L jars)

- Seasonings and spice mixes

- Yeast and baking powder

If your family spends heavily on groceries every month, this change is like getting a bonus every time you shop.

When Will the GST Cut Be Effective?

The government has indicated that these changes could be implemented by October 2025, just in time for Diwali shopping.

This isn’t just about festive discounts—it’s a long-term structural change that could boost India’s domestic economy. By making goods cheaper, the government hopes:

- Families will spend more freely.

- Small traders and MSMEs will see higher sales.

- Overall, the economy will get a fresh push as consumption increases.