Have you ever thought about what happens to all those years you’ve given to a company once you finally decide to move on? Maybe you’ve been loyal, working day and night, but when it comes time to leave—what do you actually get apart from memories and experience?

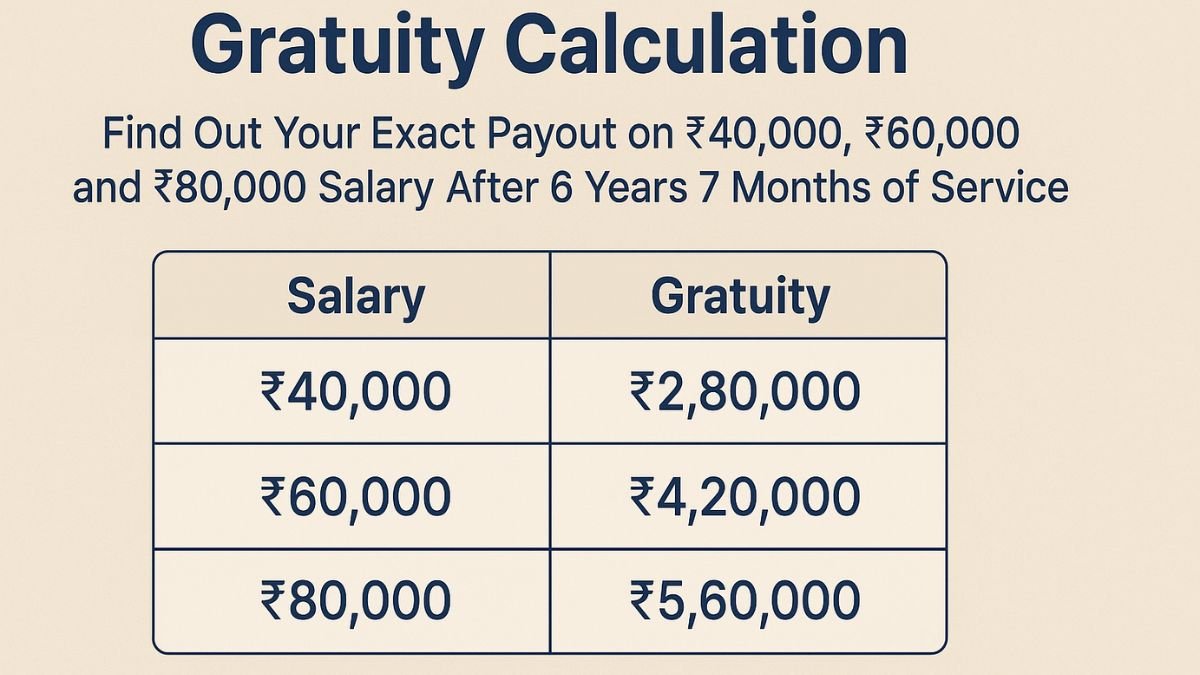

That’s where gratuity steps in. Think of it as a “thank you” payment from your employer for sticking around and contributing for years. Many employees don’t even realize how much this benefit can add up to. If your last drawn salary was ₹40,000, ₹60,000, or ₹80,000 and you’ve worked for 6 years and 7 months, you may be surprised at the exact amount you’re entitled to.

Who Is Eligible for Gratuity Under Indian Law?

Not everyone can claim gratuity. It comes with some rules, and here’s the simplest way to understand it:

- You need at least 5 years of continuous service in the same company.

- The company should have 10 or more employees on its payroll.

- Even if you resign, retire, or superannuate, gratuity is yours as long as you’ve crossed that 5-year mark.

- In cases of death or permanent disability, the 5-year rule doesn’t apply.

So, if you’ve been working for 6 years and 7 months, yes—you’re eligible. And that extra 7 months plays a big role in increasing your payout.

When Can You Actually Claim Gratuity?

You don’t have to wait until retirement. Gratuity becomes payable under these situations:

- Retirement (normal or early)

- Resignation (as long as you’ve completed 5 years)

- Superannuation (when you reach the company’s official retirement age)

- Death or disability (in which case your family or nominee gets it)

Think of gratuity as a safety net. Whether you’re planning to change jobs, retire, or life throws an unexpected curveball, this lump sum can give you much-needed financial breathing room.

How Partial Years Are Counted in Gratuity

Here’s something most people don’t know: gratuity calculations round up your service if it crosses half a year.

- If you worked 6 years and 4 months, it’s counted as 6 years.

- But if you worked 6 years and 7 months, it’s counted as 7 years.

That extra 3 months adds an entire year’s worth of gratuity to your payout. Think about that—a small extension in your service can make a big difference.

The Formula for Gratuity Calculation

The official formula under the Payment of Gratuity Act, 1972 is:

Gratuity = (Last Drawn Salary × Years of Service × 15) ÷ 26

Here’s what that means:

- Last Drawn Salary = Basic Salary + Dearness Allowance (DA)

- Years of Service = Rounded based on months (as explained above)

- 15 = 15 days of salary per year

- 26 = Average working days in a month

This formula ensures that your gratuity payout is directly tied to your salary and loyalty to the company.

Gratuity on ₹40,000 Salary After 6 Years 7 Months of Servic

Let’s do the math step by step:

- Years of Service = 7 (rounded up from 6 years 7 months)

- Formula: (40,000 × 7 × 15) ÷ 26

- Payout = ₹1,61,538

That’s over 1.6 lakh rupees just waiting for you. Imagine how that could help whether it’s paying off a loan, investing for your child’s future, or simply creating an emergency fund.

Gratuity on ₹60,000 Salary After 6 Years 7 Months of Service

Now, if your last drawn salary was higher, your payout gets more exciting:

- Years of Service = 7

- Formula: (60,000 × 7 × 15) ÷ 26

- Payout = ₹2,42,308

That’s nearly 2.5 lakh rupees a solid cushion for future plans or unexpected needs.

Gratuity on ₹80,000 Salary After 6 Years 7 Months of Service

Here’s where things get really interesting:

- Years of Service = 7

- Formula: (80,000 × 7 × 15) ÷ 26

- Payout = ₹3,23,077

Over 3.2 lakh rupees and remember, this isn’t an investment or bonus. It’s your legal right. Money you’ve earned simply by being loyal to your job.

Tax Benefits on Gratuity

Here’s the cherry on top: gratuity payouts are tax-free up to ₹20 lakh as per current income tax laws.

- If your gratuity is below ₹20 lakh, you don’t pay a single rupee in tax.

- If it’s above that, only the extra amount gets taxed.

This makes gratuity one of the most tax-friendly retirement and exit benefits you can enjoy.

FAQs on Gratuity Calculation

1. Is gratuity given in every company?

Not necessarily. Only companies with 10 or more employees are legally bound to provide gratuity.

2. Do I get gratuity if I resign before 5 years?

No, unless resignation is due to disability. The minimum eligibility is 5 years of service.

3. Is gratuity part of my monthly salary?

No. It’s a one-time lump sum paid when you leave after qualifying service.

4. Can I negotiate gratuity with my employer?

The formula is fixed by law. However, some employers may offer ex-gratia payments on top of legal gratuity.

5. How soon is gratuity paid after leaving the company?

Legally, your employer must pay it within 30 days of your exit.