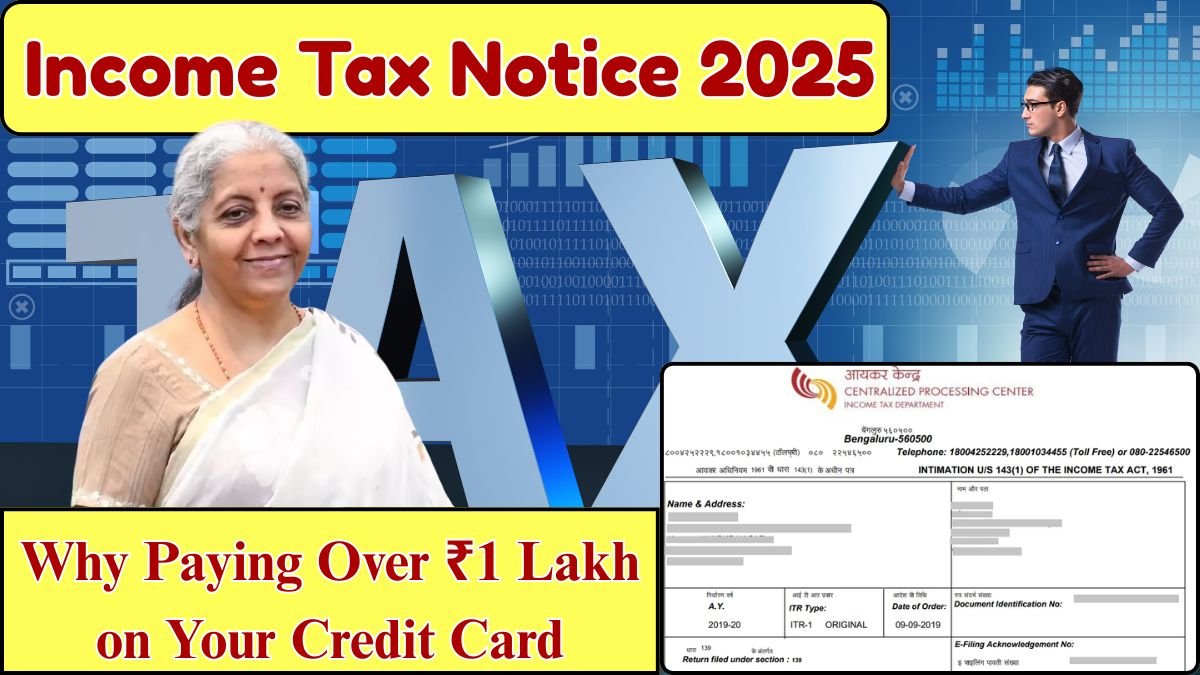

Income tax Notice on credit card You probably swipe your credit card without thinking twice—groceries, travel, maybe a dinner out. And when the bill comes, you clear it. Simple, right? But here’s the catch: if your credit card bill crosses ₹1 lakh and you pay it in cash, the Income Tax Department might start asking questions.

Why Does the Income Tax Department Care About Credit Card Payments?

Most people assume that credit card transactions are just between you and the bank. But that’s not true anymore. The tax department is keeping a close eye on spending patterns, especially when it comes to high-value transactions.

According to tax rules:

- If you pay over ₹1 lakh in cash against your credit card bill, it raises a red flag.

- If your annual credit card spending crosses ₹2 lakh, that data also goes straight to the Income Tax Department.

In both cases, the department checks whether your declared income in your ITR (Income Tax Return) actually matches the lifestyle your spending suggests. If there’s a gap, a tax notice could land at your doorstep.

Real Example: Why This Matters

Imagine this—you earn ₹40,000 a month, but your credit card expenses cross ₹2 lakh in a year. You then clear a bill of ₹1.25 lakh in cash. To you, maybe that money came from savings or a gift. But to the Income Tax Department, it looks like undisclosed income.

How to Avoid Income Tax Notice on Credit Card Spending

Here are some practical steps you can take to stay safe:

- Avoid cash payments for large bills. Always use digital methods like UPI, net banking, or cheque.

- Be honest in your ITR. If you spent more, make sure your declared income supports it.

- Keep records. If you use savings or gifts for payments, keep proper documentation.

- Stay under the radar. Try not to exceed the ₹1 lakh cash threshold—because that’s where suspicion starts.

FAQs on Income Tax Notice and Credit Card Payments

- Does every credit card payment above ₹1 lakh get flagged?

Not automatically. But if you pay it in cash, it definitely attracts attention. - Is digital payment for high bills safe?

Yes. If you pay digitally and your spending matches your declared income, there’s no issue. - Can I ignore a tax notice?

Never. Ignoring a notice can lead to fines and legal trouble. Always respond on time. - What if the money came from a family gift?

That’s acceptable—but you need to explain it clearly and, if possible, show proof. - Will using multiple cards hide expenses from tax authorities?

No. Banks report your aggregate credit card transactions to the department. Splitting bills doesn’t help.